It is the point at which costs are covered, with no profit or loss. Therefore, thanks to this analysis, it would be possible to know from what moment performance is obtained.

Benefits of conducting the analysis

- Allows you to make better decisions based on facts

- Helps to set prices in order to seek to cover costs

- Helps to specify the expenses incurred by the company

- Limit risks

- Establish clear and achievable objectives, by knowing both the prices and the quantity to sell to achieve profitability

- Attract funders, since it estimates the viability of the restaurant (for this reason it is included in the business plan).

How is it calculated?

Different formulas are used to perform the analysis, by using them you can obtain the equilibrium point in units or in money. To perform the calculation properly, it is vital to know the difference between fixed and variable costs.

The first are those that are maintained, even if the company stops producing, such as rent and salaries; while the latter are changing and depend on production, such is the case of raw materials and sales commissions.

Now let’s solve a simple exercise in order to better understand the balance point. Suppose you want to find the quantity of the good or service to be sold in order to neither gain nor lose. How many combos (arepa and drink) does an arepera have to sell monthly if the price per unit is $ 9, the variable costs per unit are $ 5, and the fixed costs are $ 1,000?

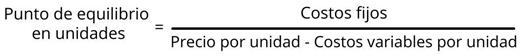

The formula to use would be to divide the fixed costs by the difference resulting from the price per unit of each combo minus the variable costs per unit:

Then the values are substituted in the formula and the operation is carried out:

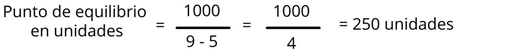

So this arepera would have to sell 250 combos to break even. Then, once the number of units that need to be sold is known, you can multiply that figure by the price of each combo to convert the number of units into money, in order to know how much is the equivalent in money that is required to obtain for neither win or lose.

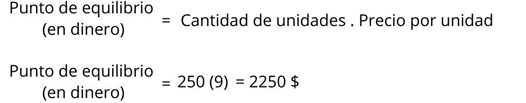

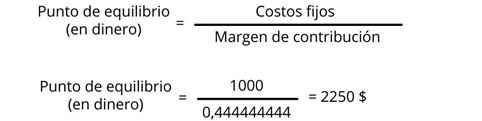

On the other hand, if you want to calculate the breakeven point (in money) and you do not know the quantities of units needed to sell, you must first determine the contribution margin. To do this, the difference between the price per unit and the variable costs per unit of producing it is obtained, dividing the result by the price per unit.

It is worth mentioning that the contribution margin is important because it indicates how much the product contributes to sustaining the business, thus allowing us to decide whether it is profitable to continue producing the dish. When performing the calculations, all decimals are preserved for a more accurate result.

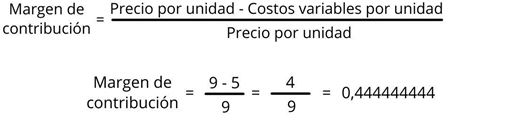

As we already know what the contribution margin is, we proceed to calculate the breakeven point (in money), which is done by dividing the fixed costs by the contribution margin:

When the sales of the arepera combos reach $ 2,250, the breakeven point (in money) would be reached.

The closer you are to the breakeven point, the less there will be loss. In this sense, it is appropriate to reduce the balance point, to have the profit zone closer and to reach it with greater ease, less effort and risk.

How to lower the balance point?

- Limit fixed costs as much as possible, for example: downsizing, getting a lower rental payment.

Minimize variable costs. Which could be achieved by seeking greater efficiency in production processes through the use of technology and reducing waste. - Increase prices, as long as that increase generates greater total income, by multiplying the price per unit by the number of units sold.

From P.A.N. Food Business Solutions we invite you to determine the balance point of your gastronomic business and thus enjoy the advantages that this generates. Ready to start? You could perform the calculation in programs like Excel to make the process easier.

References

EmprendePyme. (12 de julio de 2017). Costos variables: https://www.emprendepyme.net/costes-variables.html

Flores, J. Punto de equilibrio en una empresa: qué es y cómo se calcula: https://blog.hubspot.es/sales/punto-equilibrio-empresa

Miami Diario. (12 de octubre de 2018). ¿Quieres comer arepas?: aquí los 10 mejores sitios en Miami para degustar: https://miamidiario.com/quieres-comer-arepas-aqui-los-10-mejores-sitios-en-miami-para-degustar/

Muente, G. (20 de marzo de 2019). ¿Qué es el punto de equilibrio y cómo identificarlo?: https://rockcontent.com/es/blog/punto-de-equilibrio/

Universidad ESAN. (15 de mayo de 2017). Decisiones empresariales a partir del análisis del margen de contribución: https://www.esan.edu.pe/apuntes-empresariales/2017/05/decisiones-empresariales-a-partir-del-analisis-del-margen-de-contribucion/

U.S Small Business Administration. Break – Even Point: https://www.sba.gov/breakevenpointcalculator

U.S Small Business Administration. Calculate Your Break – Even Point: https://www.sba.gov/breakevenpointcalculator/calculate/

About us

P.A.N. Food Business Solutions is the link area of the P.A.N. with restaurateurs and gastronomic entrepreneurs whose main offer is products made from precooked corn flour.

We provide training in the pillar areas of restoration for our partners’ businesses through versatile solutions and we support them in building the foundations for their successful growth.

Excelente información!!!

Nos alegra que te resulte de utilidad, Jesús; no te pierdas el resto de artículos.

¡Saludos!

Great opportunity to learn and get business tools to make grow up my project guided by this experienced brand. Thanks

Hello, Jose

Thank you for letting us know your opinión about the course! You’ll learn a lot from us.

miryeormi@gmail.com

Mirla, puedes registrarte en el programa desde el botón “P.A.N. Food Business Journey” en el menú de este blog.

Hola estoy interesada en el curso gracias amigo

Hola, Jennyfer. Nos alegra que quieras adquirir las herramientas que este programa tienen para ofrecerte.

Puedes ingresar a nuestro programa de entrenamiento y formación desde el botón que dice “P.A.N. Food Business Journey” en el menú principal.